As Foreclosure laws in my state takes center stage, this opening passage beckons readers into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

In this comprehensive guide, we delve into the intricacies of foreclosure laws, empowering homeowners with the knowledge they need to navigate this complex legal landscape. From understanding the foreclosure process to exploring alternatives and seeking legal assistance, we cover every aspect to help you make informed decisions and protect your rights.

Understanding Foreclosure Laws in Your State

Foreclosure laws vary from state to state, so it’s crucial to understand the legal framework governing foreclosure proceedings in your state. This knowledge will help you navigate the process effectively and protect your rights as a homeowner or lender.

Generally, foreclosure involves a series of steps that begin with a lender filing a complaint against a homeowner who has defaulted on their mortgage payments. The court then reviews the complaint and, if it finds that the lender has a valid claim, will issue an order of foreclosure.

Key Steps in a Foreclosure Process

- Default on mortgage payments

- Lender files a complaint with the court

- Court reviews the complaint and issues an order of foreclosure

- Notice of foreclosure is served to the homeowner

- Homeowner has a period of time to redeem the property (varies by state)

- If the homeowner does not redeem the property, it is sold at a foreclosure sale

- The proceeds from the sale are used to pay off the mortgage debt and other expenses

- Any remaining proceeds are returned to the homeowner

Rights and Responsibilities of Homeowners and Lenders

Homeowners have the right to receive notice of foreclosure proceedings and to contest the foreclosure. They also have the right to redeem the property by paying off the mortgage debt and other expenses before the foreclosure sale. Lenders have the right to foreclose on a property if the homeowner defaults on their mortgage payments. They also have the right to pursue a deficiency judgment against the homeowner for any remaining debt after the foreclosure sale.

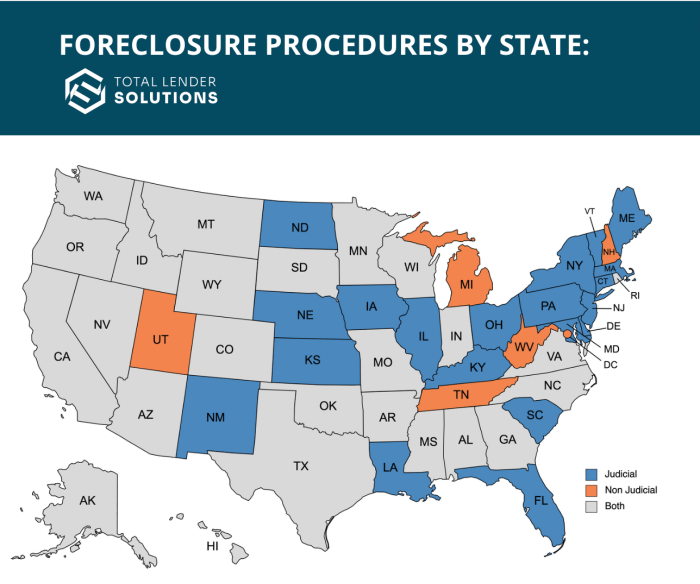

Types of Foreclosure

Foreclosure laws vary from state to state, and understanding the types of foreclosure proceedings available in your state is crucial for homeowners and lenders alike.

In general, there are two main types of foreclosure: judicial foreclosure and non-judicial foreclosure.

Judicial Foreclosure

Judicial foreclosure is a legal proceeding that requires a court order to sell the property. This type of foreclosure is typically more time-consuming and expensive than non-judicial foreclosure.

- Procedure: The lender files a lawsuit against the homeowner, and the court will hold a hearing to determine if the homeowner is in default on the mortgage.

- Timeline: The judicial foreclosure process can take several months or even years to complete.

- Impact: Judicial foreclosure can have a significant impact on homeowners, as they may lose their home and have their credit damaged.

Non-Judicial Foreclosure

Non-judicial foreclosure is a process that does not require a court order. This type of foreclosure is typically faster and less expensive than judicial foreclosure.

- Procedure: The lender follows the procedures Artikeld in the mortgage contract to sell the property.

- Timeline: The non-judicial foreclosure process can typically be completed in a matter of weeks or months.

- Impact: Non-judicial foreclosure can also have a significant impact on homeowners, but it is generally less damaging to their credit than judicial foreclosure.

Foreclosure Prevention Programs: Foreclosure Laws In My State

If you’re facing foreclosure, there are several government and non-profit programs that can help. These programs can provide financial assistance, legal advice, and other resources to help you stay in your home.

Understanding the nuances of Foreclosure laws in my state is crucial for homeowners facing financial hardship. To delve deeper into the legal framework governing foreclosures, I highly recommend visiting Foreclosure laws in my state . This comprehensive resource provides detailed information on the foreclosure process, including timelines, legal rights, and options available to homeowners.

By staying informed about Foreclosure laws in my state, you can make informed decisions and protect your interests during this challenging time.

To be eligible for these programs, you must meet certain criteria, such as being behind on your mortgage payments and facing foreclosure. You will also need to provide documentation of your financial situation, such as your income and expenses.

Government Programs

The government offers several programs to help homeowners facing foreclosure, including:

- The Home Affordable Modification Program (HAMP): This program allows homeowners to modify their mortgages to make them more affordable.

- The Home Affordable Refinance Program (HARP): This program allows homeowners to refinance their mortgages at a lower interest rate, even if they are underwater on their loan.

- The Making Home Affordable Program (MHA): This program provides a range of foreclosure prevention options, including principal reduction, loan modification, and forbearance.

Non-Profit Programs

There are also a number of non-profit organizations that offer foreclosure prevention services, including:

- The National Foreclosure Mitigation Counseling Program: This program provides free foreclosure counseling to homeowners facing foreclosure.

- The HOPE NOW Alliance: This alliance of mortgage lenders and counselors offers a range of foreclosure prevention options.

- The Center for Responsible Lending: This organization provides research and advocacy on behalf of homeowners facing foreclosure.

If you are facing foreclosure, it is important to seek help from a qualified foreclosure prevention counselor. A counselor can help you understand your options and guide you through the process of applying for foreclosure prevention programs.

Legal Assistance for Homeowners

Navigating foreclosure proceedings can be overwhelming and complex. Seeking professional legal guidance is crucial to protect your rights and explore options available to you.

Various resources are available to assist homeowners facing foreclosure:

Legal Aid Organizations

- Provide free or low-cost legal services to low-income individuals and families.

- Specialize in housing law, including foreclosure defense.

- Offer representation in court, negotiations with lenders, and mediation.

Pro Bono Attorneys

- Volunteer their services to represent clients in civil cases, including foreclosure defense.

- Provide legal advice, file motions, and represent clients in court.

- May have experience in foreclosure law and can offer valuable assistance.

Importance of Seeking Legal Advice

It is imperative to seek legal advice before making any decisions related to foreclosure. An attorney can:

- Review your loan documents and foreclosure proceedings.

- Identify potential defenses and legal strategies.

- Negotiate with lenders on your behalf.

- Represent you in court and protect your interests.

Legal assistance can significantly improve your chances of successfully navigating foreclosure proceedings and preserving your home.

Alternatives to Foreclosure

Facing foreclosure can be an overwhelming and stressful experience. However, there are alternatives to foreclosure that may help you keep your home and avoid financial ruin.

Two common alternatives to foreclosure are loan modifications and short sales. Let’s explore these options and their potential impact on your financial future.

Loan Modifications

A loan modification involves working with your lender to change the terms of your mortgage, such as reducing the interest rate, extending the loan term, or forgiving a portion of the debt. Loan modifications can make your mortgage more affordable and help you stay in your home.

Advantages of loan modifications:

- Can keep you in your home

- May reduce your monthly payments

- Can improve your credit score over time

Disadvantages of loan modifications:

- Can be difficult to qualify for

- May extend the term of your mortgage

- May not be available from all lenders

Short Sales

A short sale occurs when you sell your home for less than what you owe on your mortgage. The proceeds from the sale are used to pay off the mortgage, and any remaining debt is forgiven. Short sales can help you avoid foreclosure and damage to your credit.

Advantages of short sales:

- Can help you avoid foreclosure

- May result in less damage to your credit than foreclosure

- Can be a faster process than foreclosure

Disadvantages of short sales:

- May not be available from all lenders

- Can be difficult to qualify for

- May result in a tax liability

Ultimately, the best alternative to foreclosure for you will depend on your individual circumstances. It’s important to weigh the advantages and disadvantages of each option carefully before making a decision.

Foreclosure Impact on Homeowners

Foreclosure is a complex and stressful process that can have devastating consequences for homeowners. Financially, foreclosure can result in the loss of a home, damage to credit scores, and the accumulation of debt. Emotionally, foreclosure can lead to feelings of shame, anxiety, and depression.

Financial Consequences, Foreclosure laws in my state

The most immediate financial consequence of foreclosure is the loss of a home. This can be a devastating blow, both financially and emotionally. Homeowners who lose their homes through foreclosure may have to move into temporary housing or even become homeless. They may also lose the equity they have built up in their homes, which can make it difficult to purchase a new home in the future.

In addition to losing their homes, homeowners who face foreclosure may also see their credit scores damaged. A foreclosure will stay on a credit report for seven years, making it difficult to obtain loans or other forms of credit. This can make it difficult to rent an apartment, get a job, or even open a bank account.

Foreclosure can also lead to the accumulation of debt. Homeowners who are unable to make their mortgage payments may fall behind on other bills, such as property taxes and utilities. This can lead to additional debt and financial hardship.

Emotional Consequences

Foreclosure can also have a significant emotional impact on homeowners. The loss of a home can be a traumatic experience, and it can lead to feelings of shame, anxiety, and depression. Homeowners who face foreclosure may also feel like they have failed, which can damage their self-esteem.

The emotional consequences of foreclosure can be long-lasting. Homeowners who have lost their homes through foreclosure may experience difficulty sleeping, eating, and concentrating. They may also withdraw from social activities and avoid talking about their situation.

Resources and Support for Homeowners Facing Foreclosure

If you are facing foreclosure, there are a number of resources and support programs available to help you. These programs can provide financial assistance, legal advice, and emotional support.

* The Homeowner’s HOPE Hotline: 1-888-995-HOPE (4673)

* The National Foreclosure Mitigation Counseling Program: 1-888-995-HOPE (4673)

* The Legal Aid Society: 1-800-221-3943

These programs can help you understand your options and make the best decisions for your situation.

Final Thoughts

Remember, facing foreclosure can be a daunting experience, but it’s crucial to approach it with knowledge and a proactive mindset. By understanding the laws and available resources, you can navigate this challenging time and emerge with a clear path forward.

FAQ Explained

What are the key steps involved in a foreclosure process in my state?

The specific steps may vary slightly depending on your state’s laws, but generally involve a notice of default, a foreclosure complaint, a judgment of foreclosure, and a sheriff’s sale.

What are my rights as a homeowner facing foreclosure?

Your rights vary by state, but typically include the right to receive notice of foreclosure proceedings, the right to contest the foreclosure, and the right to seek legal assistance.

Are there any government programs that can help me prevent foreclosure?

Yes, there are several government programs designed to assist homeowners facing foreclosure, such as the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP).