What happens during foreclosure – Navigating the complexities of foreclosure can be an overwhelming experience. This comprehensive guide unravels the intricacies of the foreclosure process, empowering homeowners with essential knowledge and options to safeguard their interests.

As the title suggests, “What Happens During Foreclosure,” we embark on a journey that delves into the legal, financial, and emotional aspects of this critical topic.

Default on Mortgage

Defaulting on a mortgage occurs when a borrower fails to make timely payments as agreed upon in the loan contract. This can have serious financial and personal consequences.

Common reasons for defaulting on a mortgage include:

- Loss of income

- Unexpected expenses

- Adjustable-rate mortgages (ARMs) with interest rate increases

- Overextending financially

- Personal or family emergencies

Defaulting on a mortgage can lead to:

- Late fees and penalties

- Damage to credit score

- Foreclosure

- Eviction

- Loss of equity in the home

Warning signs that may indicate a potential default include:

- Difficulty making mortgage payments on time

- Skipping or reducing payments

- Receiving notices from the lender

- Financial hardship

- Job loss or income reduction

Foreclosure Process

The foreclosure process is a legal procedure that allows a lender to seize and sell a property when the borrower defaults on their mortgage. It is a complex and time-consuming process that can have serious consequences for the borrower.

Role of the Lender, Servicer, and Courts

The lender is the company that provided the mortgage to the borrower. The servicer is the company that collects the mortgage payments and handles the foreclosure process. The courts are responsible for overseeing the foreclosure process and ensuring that it is conducted fairly.

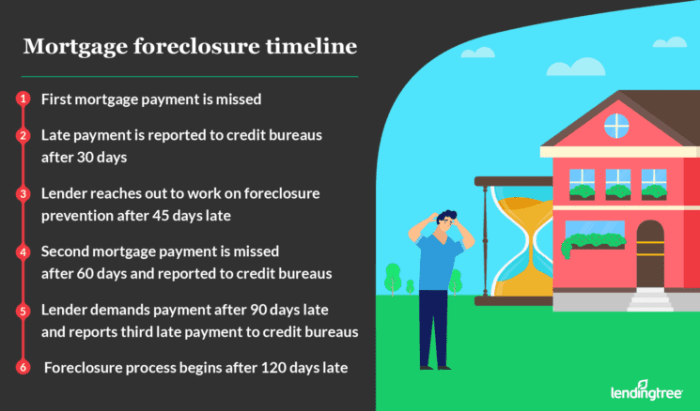

Timeline and Procedures for Each Stage of the Foreclosure Process

The foreclosure process typically involves the following stages:

- Default: The borrower fails to make mortgage payments.

- Notice of Default: The lender sends the borrower a notice of default, which gives them a specific amount of time to catch up on their payments.

- Foreclosure Sale: If the borrower does not catch up on their payments, the lender will schedule a foreclosure sale. The property will be sold to the highest bidder, and the proceeds will be used to pay off the mortgage debt.

Impact on Homeowners: What Happens During Foreclosure

Foreclosure can have a devastating impact on homeowners, both emotionally and financially. The emotional toll can be immense, as homeowners may feel a sense of shame, failure, and loss. They may also experience anxiety, depression, and other mental health issues.

Financially, foreclosure can lead to a loss of equity, damage to credit scores, and difficulty obtaining future housing. Homeowners may also face eviction and the loss of their personal belongings.

Options Available to Homeowners Facing Foreclosure

There are several options available to homeowners facing foreclosure, including:

- Loan modifications: A loan modification can change the terms of a mortgage, making it more affordable for the homeowner.

- Short sales: A short sale allows a homeowner to sell their home for less than the amount owed on the mortgage.

- Deeds-in-lieu: A deed-in-lieu allows a homeowner to transfer the title of their home to the lender in exchange for the lender forgiving the remaining mortgage debt.

Resources and Support Available to Homeowners

There are a number of resources and support available to homeowners during the foreclosure process, including:

- Housing counselors: Housing counselors can provide homeowners with free or low-cost advice and guidance on foreclosure prevention options.

- Legal aid organizations: Legal aid organizations can provide homeowners with free or low-cost legal representation in foreclosure cases.

- Government programs: There are a number of government programs available to help homeowners avoid foreclosure, including the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP).

Impact on the Community

Foreclosure can have a significant impact on local communities. When a home is foreclosed upon, it can lead to a decrease in property values in the neighborhood, as well as an increase in crime and blight. This can make it difficult for residents to sell their homes or obtain financing for home improvements.

Neighborhood Blight and Crime

Foreclosed homes are often left vacant and abandoned, which can lead to neighborhood blight. This can attract crime and other problems, such as vandalism, squatting, and drug use. In addition, foreclosed homes can become a breeding ground for pests, which can pose a health hazard to residents.

Potential Solutions

There are a number of potential solutions to mitigate the negative effects of foreclosure on communities. One solution is to provide financial assistance to homeowners who are at risk of foreclosure. This can help them to stay in their homes and avoid foreclosure. Another solution is to create community programs that help to revitalize foreclosed homes and neighborhoods. These programs can provide job training, home repair assistance, and other services to help residents improve their communities.

Legal and Ethical Considerations

Foreclosure is a complex legal process with significant implications for all parties involved. Understanding the legal rights and responsibilities of lenders, servicers, and homeowners is crucial to ensure fairness and equity throughout the process.

Lenders have the legal right to foreclose on a property if the borrower defaults on their mortgage payments. However, they must follow specific procedures and provide homeowners with proper notice and an opportunity to resolve the default.

Ethical Implications, What happens during foreclosure

Foreclosure can have devastating consequences for homeowners, including loss of housing, financial ruin, and emotional distress. Ethical considerations arise when examining the fairness and equity of the foreclosure process.

Foreclosure can be a scary process, and it’s important to know what happens during foreclosure so you can take steps to protect yourself. If you’re facing foreclosure, there are resources available to help you. Foreclosure assistance programs can help you get the information and support you need to avoid foreclosure or get back on your feet after foreclosure.

These programs can provide you with legal advice, financial counseling, and other resources to help you through this difficult time.

Critics argue that foreclosure laws favor lenders and servicers over homeowners, leading to unfair outcomes. They point to cases where homeowners have been foreclosed upon even when they have made good-faith efforts to avoid default.

Legal Cases and Regulations

Numerous legal cases and regulations have been enacted to address the legal and ethical concerns surrounding foreclosure.

- The Home Affordable Modification Program (HAMP) was created to help homeowners avoid foreclosure by modifying their mortgages.

- The Dodd-Frank Wall Street Reform and Consumer Protection Act included provisions to protect homeowners from unfair foreclosure practices.

- The Consumer Financial Protection Bureau (CFPB) has issued regulations to ensure that servicers follow fair and ethical foreclosure procedures.

Final Review

Foreclosure can have far-reaching consequences, not only for homeowners but also for communities and the economy as a whole. Understanding the process and exploring available options can help homeowners mitigate the negative impact and make informed decisions.

General Inquiries

What are the common reasons for mortgage default?

Job loss, financial hardship, unexpected expenses, and adjustable-rate mortgages are some common reasons.

What are the legal rights of homeowners during foreclosure?

Homeowners have the right to receive proper notice, challenge the foreclosure, and explore options such as loan modifications or short sales.

What are the financial consequences of foreclosure?

Foreclosure can damage credit scores, result in a deficiency judgment, and lead to the loss of the home and equity.