Facing foreclosure on a manufactured home can be stressful, but you’re not alone. This guide equips you with knowledge to navigate the process and protect your rights.

Understanding the Uniqueness of Manufactured Homes

Manufactured homes, often called mobile homes, can be classified as either personal property or real estate depending on your state. This distinction significantly impacts the foreclosure process.

Key Differences from Traditional Foreclosure

- Faster Foreclosure: Foreclosure on manufactured homes is typically quicker than traditional real estate due to the personal property classification in many states.

- Shorter Redemption Period: The timeframe to reclaim the property after foreclosure (redemption period) is usually shorter for manufactured homes.

- Limited Deficiency Judgments: Deficiency judgments, where lenders pursue unpaid balances after foreclosure, are less common with manufactured homes due to their lower value.

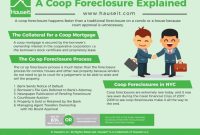

The Foreclosure Process for Manufactured Homes

-

Default on Mortgage Payments: The process begins when you miss mortgage payments. The lender will send a notice of default outlining the missed amount and timeline to catch up.

-

Notice of Default Filing: If you fail to respond to the notice, the lender files it publicly, notifying potential buyers of the impending foreclosure.

-

Foreclosure Sale: Unresolved defaults lead to a foreclosure sale, where the home is auctioned to the highest bidder. The proceeds pay off the mortgage, fees, and any remaining balance might be returned to you.

-

Redemption Rights: After the sale, you may have the right to redeem the property within a state-defined period (typically 6 months to a year) by paying the foreclosure judgment amount and associated costs.

Protecting Yourself: Resources and Support

- Legal Aid and Pro Bono Attorneys: Don’t hesitate to seek legal assistance. Legal aid organizations and pro bono attorneys can offer free or low-cost guidance on foreclosure prevention, loan modifications, and legal defense.

- Foreclosure Mediation Programs: These government-backed programs facilitate communication between you and the lender to explore solutions that might help you avoid foreclosure.

Remember:

- Each state has its own foreclosure laws. Researching the specifics in your state is crucial.

- Manufactured home foreclosures have complexities. Consider seeking legal help to understand your options fully.

- By understanding your rights, you can explore possibilities to save your home. There might be foreclosure prevention programs or loan modifications available.

Empower Yourself with Knowledge

Foreclosure can be a difficult situation, but knowledge is your best weapon. By familiarizing yourself with the laws and available resources, you can navigate this process with more confidence and protect your interests.

Taking Action to Avoid Foreclosure

While this guide has equipped you with knowledge about the foreclosure process, preventing foreclosure altogether is the ideal scenario. Here are some steps you can take:

- Communicate with Your Lender: Open communication is key. As soon as you anticipate difficulty making payments, contact your lender. They might be able to offer loan modification programs to adjust your loan terms and make payments more manageable.

- Explore Foreclosure Alternatives: Several programs can assist homeowners facing foreclosure. The Department of Housing and Urban Development (HUD) offers resources to find these programs in your area https://www.hud.gov/topics/avoiding_foreclosure.

- Consider Selling Your Manufactured Home: If keeping the home becomes impossible, selling it before foreclosure can be a better option. You’ll have more control over the sale price and walk away with some equity.

Important Considerations

- Fair Housing Act Protections: The Fair Housing Act protects homeowners from discrimination during the foreclosure process. If you suspect discrimination based on race, ethnicity, religion, etc., you can file a complaint with the Department of Housing and Urban Development (HUD) https://www.hud.gov/program_offices/fair_housing_equal_opp/fair_housing_rights_and_obligations

- Tax Implications: Foreclosure can have tax consequences. Consult a tax advisor to understand how it might impact your tax filing.

Conclusion

Foreclosure laws for manufactured homes involve unique aspects compared to traditional real estate. By staying informed about your rights, exploring all options, and seeking professional help if needed, you can navigate this challenging situation with greater confidence. Remember, you’re not alone in this process. There are resources and support systems available to help you through these difficult times.

Answers to Common Questions

What are the key differences between foreclosure laws for manufactured homes and traditional real estate?

Manufactured homes are considered personal property in most states, which affects the foreclosure process and redemption rights.

What federal protections are available to homeowners facing foreclosure on a manufactured home?

The Homeowners Protection Act (HPA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act provide important protections, including the right to notice and a foreclosure mediation process.

What is the process for foreclosing on a manufactured home?

Typically involves default on mortgage payments, notice of default, and a foreclosure sale.

What redemption rights do manufactured homeowners have after a foreclosure sale?

Homeowners may have the right to redeem the property within a specified period by paying the outstanding debt and costs.

Where can I find legal assistance if I am facing foreclosure on my manufactured home?

Legal aid organizations, pro bono attorneys, and foreclosure mediation programs offer support and guidance to homeowners in need.

Foreclosure laws for manufactured homes can be complex, varying from state to state. To ensure you fully understand the legal landscape, it’s crucial to research the foreclosure laws in your state . This will help you navigate the process effectively and protect your rights as a homeowner.

While foreclosure laws for manufactured homes share similarities with those for traditional homes, there are often unique considerations that require specialized knowledge.

Foreclosure laws for manufactured homes can be complex, but it’s important to understand your rights. If you’re facing foreclosure, you may have options to protect your home. Learn more about foreclosure rights for homeowners and how they apply to manufactured homes.

By understanding your rights, you can take steps to avoid foreclosure and keep your home.

Foreclosure laws for manufactured homes are different from those for traditional homes. The foreclosure process for manufactured homes is generally shorter and less complex. For a detailed understanding of the foreclosure process timeline, check out this helpful guide: Foreclosure process timeline . This guide provides a step-by-step breakdown of the foreclosure process, including the timelines and key deadlines.

Knowing the foreclosure laws for manufactured homes and the foreclosure process timeline can help you navigate this challenging situation effectively.

Foreclosure laws for manufactured homes can be complex and vary from state to state. If you’re facing foreclosure, it’s important to seek legal assistance. Foreclosure assistance can help you understand your rights and options, and can negotiate with your lender on your behalf.

Foreclosure laws for manufactured homes are designed to protect homeowners, but it’s important to understand your rights and responsibilities to avoid losing your home.