Foreclosure laws for cooperatives present a unique set of challenges and complexities. This comprehensive guide explores the legal framework governing foreclosure proceedings, analyzes variations across jurisdictions, and delves into the intricacies faced by cooperatives in these situations.

Foreclosure laws for cooperatives aim to balance the rights of individual owners with the collective interests of the cooperative community. Understanding these laws is crucial for both cooperative members and management to navigate foreclosure proceedings effectively.

Foreclosure Laws for Cooperatives

Foreclosure laws for cooperatives are a complex and evolving area of law. The legal framework governing foreclosure laws for cooperatives varies from jurisdiction to jurisdiction, and there are a number of unique challenges that cooperatives face in foreclosure proceedings.

In general, foreclosure laws for cooperatives are designed to protect the interests of both the cooperative and its members. However, the specific provisions of these laws can vary significantly from one jurisdiction to another.

Foreclosure laws for cooperatives can be complex and vary from state to state. If you’re facing foreclosure on your cooperative, it’s important to understand your rights and options. For more information on foreclosure laws, including those specific to agricultural properties, visit Foreclosure laws for agricultural . Understanding the legal landscape can help you navigate the foreclosure process and protect your interests.

Comparative Analysis of Foreclosure Laws for Cooperatives in Different Jurisdictions

A comparative analysis of foreclosure laws for cooperatives in different jurisdictions reveals a number of similarities and differences. In most jurisdictions, foreclosure laws for cooperatives are based on the principle that the cooperative has a right to foreclose on a member’s unit if the member defaults on their mortgage or other financial obligations to the cooperative.

Foreclosure laws for cooperatives can be complex and vary by jurisdiction. However, there are some general principles that apply to all cooperatives. For instance, if a cooperative member fails to pay their mortgage or other assessments, the cooperative may foreclose on the member’s unit.

This means that the cooperative can sell the unit to satisfy the debt. If you’re facing foreclosure, it’s important to understand your rights and options. You may have the right to contest the foreclosure or to negotiate a payment plan.

For more information on your foreclosure rights, visit Foreclosure rights for homeowners . Understanding your rights can help you make informed decisions about your options and protect your interests. Remember, foreclosure laws for cooperatives are designed to protect both the cooperative and its members.

However, there are a number of important differences in the foreclosure laws for cooperatives in different jurisdictions. For example, in some jurisdictions, cooperatives are required to provide members with a grace period before foreclosing on their units. In other jurisdictions, cooperatives are not required to provide members with any grace period.

Foreclosure laws for cooperatives can be complex and challenging to navigate. If you’re facing foreclosure, it’s important to seek legal advice and explore all of your options. There are a number of foreclosure assistance programs available that can help you avoid foreclosure and keep your home.

To learn more about these programs, visit Foreclosure assistance programs . These programs can provide financial assistance, legal counseling, and other resources to help you through the foreclosure process. If you’re facing foreclosure, don’t hesitate to reach out for help.

There are resources available to help you keep your home.

Unique Challenges Faced by Cooperatives in Foreclosure Proceedings

Cooperatives face a number of unique challenges in foreclosure proceedings. One of the biggest challenges is the fact that cooperatives are often owned by their members. This means that when a cooperative forecloses on a member’s unit, it is essentially foreclosing on its own property.

Another challenge that cooperatives face in foreclosure proceedings is the fact that they are often not-for-profit organizations. This means that cooperatives do not have the same financial resources as for-profit corporations. As a result, cooperatives may be less able to afford the costs of foreclosure proceedings.

If you’re struggling to make mortgage payments on your co-op, it’s crucial to understand the foreclosure laws that apply. These laws can vary depending on your state and the type of co-op you live in. For instance, foreclosure laws for vacant properties may differ from those for occupied co-ops.

Therefore, it’s essential to consult with an attorney to get specific advice about your situation and the foreclosure laws that apply to your co-op.

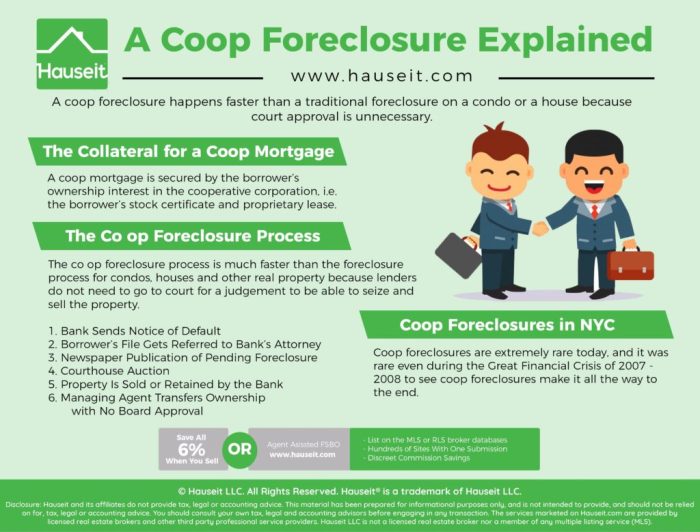

Process and Procedures

Foreclosing on a cooperative unit is a complex and time-consuming process. It is important to understand the steps involved and the role of the cooperative board and management in order to ensure a successful foreclosure.

Step-by-Step Process

- Notice of Default: The cooperative board must send a written notice of default to the shareholder who is in default.

- Opportunity to Cure: The shareholder has a period of time to cure the default.

- Acceleration of Debt: If the shareholder does not cure the default, the cooperative board may accelerate the debt, which means that the entire balance of the loan becomes due and payable immediately.

- Foreclosure Sale: The cooperative board may then sell the unit at a foreclosure sale.

- Distribution of Proceeds: The proceeds from the foreclosure sale are used to pay off the outstanding loan balance and any other costs associated with the foreclosure.

Role of the Cooperative Board and Management

The cooperative board and management play a vital role in the foreclosure process. They are responsible for:

- Sending the notice of default.

- Giving the shareholder an opportunity to cure the default.

- Accelerating the debt if the default is not cured.

- Conducting the foreclosure sale.

- Distributing the proceeds from the foreclosure sale.

Legal Notices, Timelines, and Documentation

There are a number of legal notices, timelines, and documentation that are required for foreclosure. These include:

- Notice of Default: The notice of default must be sent to the shareholder in writing and must state the amount of the default and the date by which the default must be cured.

- Opportunity to Cure: The shareholder has a period of time to cure the default, which is typically 30 days.

- Acceleration of Debt: If the default is not cured, the cooperative board may accelerate the debt, which means that the entire balance of the loan becomes due and payable immediately.

- Foreclosure Sale: The foreclosure sale must be conducted in accordance with the law and must be advertised in a newspaper.

- Distribution of Proceeds: The proceeds from the foreclosure sale are used to pay off the outstanding loan balance and any other costs associated with the foreclosure.

Defenses and Remedies: Foreclosure Laws For Cooperatives

Foreclosure proceedings involving cooperatives often present unique challenges and opportunities for both owners and the cooperative itself. Cooperative owners may raise various defenses to resist foreclosure, while they also have remedies available to protect their interests. Understanding these defenses and remedies is crucial for navigating foreclosure disputes effectively.

Common Defenses

Cooperative owners may assert several common defenses in foreclosure proceedings, including:

- Lack of Standing: The cooperative may lack standing to foreclose if it has not followed proper procedures or if the foreclosure is not authorized by the governing documents.

- Procedural Irregularities: Owners may challenge foreclosure proceedings if there were procedural irregularities, such as inadequate notice or failure to comply with statutory requirements.

- Unconscionability: The foreclosure terms may be deemed unconscionable if they are grossly unfair or oppressive to the owner.

- Statute of Limitations: The cooperative may have failed to initiate foreclosure proceedings within the applicable statute of limitations.

- Equitable Defenses: Owners may raise equitable defenses, such as laches or estoppel, to prevent foreclosure if the cooperative has delayed or misled the owner.

Remedies for Cooperative Owners

Cooperative owners facing foreclosure have several remedies available to them, including:

- Loan Modification: Owners may negotiate with the cooperative to modify the loan terms, making it more affordable and preventing foreclosure.

- Reinstatement: Owners may reinstate the loan by paying all past-due amounts and any other fees and costs associated with the foreclosure.

- Redemption: Owners may redeem the property by paying the full amount of the foreclosure judgment, plus interest and costs.

- Injunction: Owners may seek an injunction to halt the foreclosure proceedings if they can demonstrate irreparable harm or a likelihood of success on the merits of their defenses.

- Bankruptcy: Filing for bankruptcy can provide owners with an automatic stay of foreclosure proceedings, giving them time to reorganize their finances.

Legal Strategies and Tactics

In foreclosure disputes involving cooperatives, both parties employ various legal strategies and tactics to achieve their goals. Cooperative attorneys may focus on proving the validity of the foreclosure proceedings and the owner’s default. They may also seek to limit the owner’s defenses and remedies.

On the other hand, attorneys representing cooperative owners may challenge the foreclosure on procedural or substantive grounds. They may also seek to negotiate favorable terms for their clients, such as loan modifications or reinstatement options. The specific strategies and tactics employed in each case will vary depending on the facts and circumstances involved.

Impact on Cooperative Members

Foreclosure on a cooperative has severe financial and social consequences for its members. Financially, members may lose their equity in their homes, face displacement, and incur significant legal expenses. Socially, foreclosure can disrupt communities, dissolve social networks, and lead to a loss of affordable housing options.

Legal Protections for Cooperative Members, Foreclosure laws for cooperatives

Cooperative members have certain legal protections during foreclosure proceedings. These protections include:

– The right to notice of foreclosure proceedings

– The right to a hearing before a judge

– The right to redeem the cooperative by paying the outstanding debt

– The right to seek legal assistance

Strategies for Mitigating Negative Consequences

Cooperative members can take several steps to mitigate the negative consequences of foreclosure. These steps include:

– Seeking legal advice as soon as possible

– Negotiating with the lender to avoid foreclosure

– Exploring alternative housing options

– Working with community organizations to provide support and resources

Case Studies and Examples

Examining real-world cases can provide valuable insights into the application and impact of foreclosure laws on cooperatives.

Foreclosure laws for cooperatives can vary greatly from state to state. To ensure you’re familiar with the specific laws that apply to your situation, it’s essential to consult with a local attorney. Foreclosure laws in my state vary depending on the type of property, the amount of the mortgage, and other factors.

By understanding the laws that govern foreclosures in your state, you can make informed decisions about your options and protect your rights.

Landmark Case: Parkchester Apartments Co. v. Bershad

This 1969 New York Court of Appeals case established the precedent that cooperative shareholders are not entitled to the same foreclosure protections as residential homeowners. The court held that cooperatives are not subject to the state’s foreclosure moratorium, allowing the cooperative to foreclose on delinquent shareholders.

Understanding foreclosure laws for cooperatives is crucial to navigate the legal complexities involved. For a detailed breakdown of the foreclosure process, refer to the comprehensive Foreclosure process timeline . This resource provides a step-by-step guide to the timeline and procedures associated with foreclosure for cooperatives, empowering you with the knowledge to make informed decisions during this challenging process.

The case highlighted the unique legal status of cooperatives and the challenges faced by members who default on their obligations.

Recent Case: HDFC v. Chen

In this 2021 case, the New York Supreme Court ruled in favor of a cooperative in its foreclosure action against a shareholder who had fallen behind on maintenance fees. The court rejected the shareholder’s defenses based on the cooperative’s alleged mismanagement and found that the cooperative had followed proper procedures in initiating the foreclosure.

The case demonstrates the courts’ willingness to uphold the rights of cooperatives to protect their financial interests.

Trends and Patterns

Analysis of foreclosure cases involving cooperatives reveals several trends:

- Cooperatives have a high success rate in foreclosure actions due to the limited protections available to shareholders.

- Courts are generally deferential to the decisions of cooperative boards in foreclosure matters.

- Defenses based on cooperative mismanagement are often unsuccessful unless the shareholder can prove gross negligence or fraud.

Legislative and Policy Considerations

Foreclosure laws for cooperatives have been a subject of ongoing legislative and policy debates. Several initiatives and proposals aim to address concerns related to protecting cooperative members and promoting stable cooperative communities.

Current Legislative Initiatives

One notable legislative initiative is the Cooperative Member Protection Act, which proposes amendments to the Dodd-Frank Wall Street Reform and Consumer Protection Act. This act seeks to strengthen protections for cooperative members facing foreclosure by providing additional notice and due process requirements.

Potential Impact of Changes

The potential impact of these changes on cooperative housing includes:

- Increased transparency and accountability in foreclosure proceedings.

- Improved communication and support for cooperative members facing financial distress.

- Potential reduction in the number of foreclosures and displacement of cooperative members.

Recommendations for Reform

To effectively protect cooperative members and promote stable cooperative communities, foreclosure laws should be reformed to include:

- Clear and accessible foreclosure procedures that ensure due process for cooperative members.

- Mandatory pre-foreclosure counseling and mediation to assist members in exploring alternative solutions.

- Increased oversight and regulation of foreclosure practices to prevent predatory lending and unfair treatment.

Last Word

In conclusion, foreclosure laws for cooperatives are a complex and evolving area of law. By staying abreast of legal developments and understanding the unique challenges faced by cooperatives, stakeholders can navigate foreclosure proceedings more effectively. This guide provides a comprehensive overview of the legal framework, defenses, remedies, and strategies involved in foreclosure cases involving cooperatives.

FAQ Explained

What are the common defenses raised by cooperative owners in foreclosure proceedings?

Cooperative owners may raise defenses such as improper notice, procedural irregularities, lack of standing, and financial hardship.

What remedies are available to cooperative owners facing foreclosure?

Owners may seek remedies such as loan modifications, payment plans, or reinstatement of the mortgage.

How can cooperative members mitigate the negative consequences of foreclosure?

Members can explore options such as selling the unit, negotiating with the lender, or seeking legal assistance to protect their rights.