Sharing the road comes with inherent risks. Uninsured motorist coverage (UMC) emerges as a crucial shield for drivers, safeguarding them from the financial repercussions of accidents caused by uninsured or underinsured motorists. With a growing number of uninsured drivers on our roads, understanding UMC is essential for responsible drivers.

This comprehensive guide empowers you with the knowledge needed to make informed decisions regarding UMC. We’ll delve into the legalities, explore the different coverage options, navigate the claims process, and highlight the importance of maximizing your benefits. Whether you’re a seasoned driver or a new license holder, this resource equips you to protect yourself and your loved ones on the road.

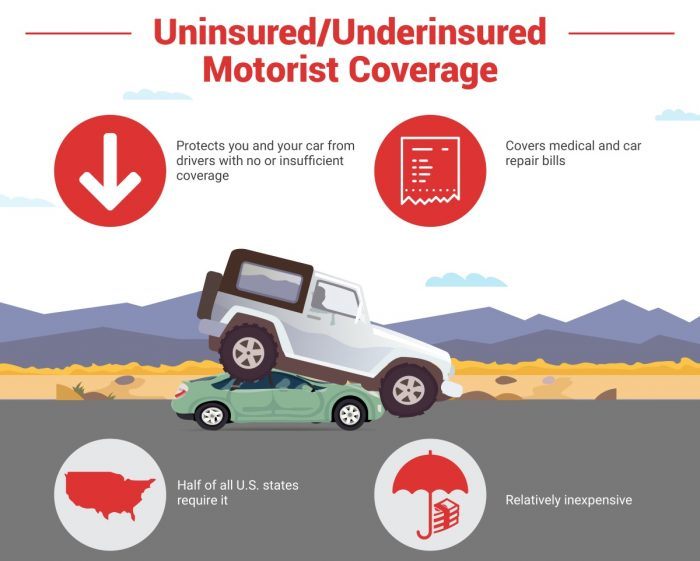

Uninsured Motorist Coverage Explained

Uninsured motorist coverage (UM) safeguards drivers from financial losses stemming from accidents involving drivers who lack adequate insurance or are completely uninsured. Imagine it as an insurance policy specifically designed for your insurance policy, offering a safety net in situations where the at-fault driver doesn’t have enough coverage.

Understanding Legal Requirements

Legal mandates for UM coverage vary by state. Some states, like New York and Pennsylvania, make UM coverage mandatory for all drivers. In contrast, states like California and Florida make it optional but strongly recommend it. Researching your state’s specific laws is crucial to determine the requirements in your area.

Types of Uninsured Motorist Coverage

UMC comes in two primary forms: bodily injury coverage and property damage coverage.

- Bodily Injury Coverage: This coverage reimburses you for medical expenses, lost wages, and other damages incurred if you’re injured in an accident with an uninsured driver.

- Property Damage Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident with an uninsured driver.

The limits of your UMC will vary depending on your policy. You typically have the option to choose from different coverage limits, such as $25,000/$50,000, $50,000/$100,000, or $100,000/$300,000. The first number represents the maximum amount your insurance company will pay for bodily injury per person, while the second number represents the maximum payout for bodily injury per accident.

Selecting the right type and amount of UMC for your needs is vital. If you’re unsure about the coverage amount you require, consult with your insurance agent.

Benefits and Limitations of Uninsured Motorist Coverage

UMC offers numerous advantages to drivers, including:

- Financial Protection: In the event of an accident with an uninsured motorist, UMC safeguards you by covering medical expenses, lost wages, and other damages.

- Peace of Mind: Knowing you have UMC provides peace of mind, ensuring you’re protected if an accident occurs.

However, it’s important to acknowledge limitations and exclusions associated with UMC:

- Coverage Limits: UMC typically has coverage limits, meaning there’s a maximum amount the insurance company will pay for damages.

- Exclusions: UMC may not cover all types of damages, such as punitive damages or pain and suffering.

It’s recommended to compare UMC to other insurance options like liability insurance and collision insurance to determine the most suitable coverage for your situation.

Cost Factors for Uninsured Motorist Coverage

The cost of UMC varies depending on several factors, including:

- Coverage Amount: The higher the coverage you choose, the higher your premium will be.

- Deductible: A higher deductible translates to a lower premium, but you’ll pay more out of pocket before your insurance kicks in.

- Driving Record: Drivers with clean records typically pay less for UMC compared to those with accidents or traffic violations on their record.

- Vehicle Type: Sports cars and high-performance vehicles generally cost more to insure than sedans or minivans.

- Location: Premiums tend to be higher in areas with a higher number of uninsured drivers.

The Importance of Uninsured Motorist Coverage

Uninsured motorist coverage emerges as a cornerstone of responsible driving. It empowers drivers with peace of mind and financial security in the face of unforeseen circumstances. By understanding the intricacies of UMC, drivers can make informed decisions regarding their coverage, ensuring they are adequately protected against the potential risks posed by uninsured motorists. As we navigate the ever-changing landscape of our roadways, UMC serves as a vital tool in safeguarding our financial well-being and promoting responsible driving practices.

UMC offers a multitude of benefits, including:

- Medical Expense Coverage: It covers medical bills arising from injuries sustained in an accident with an uninsured driver. This can include hospital stays, doctor visits, medication, physical therapy, and other necessary medical care.

- Lost Wage Coverage: It compensates for lost income if you’re unable to work due to injuries from the accident.

- Pain and Suffering Coverage: (Depending on your state’s laws) UMC may cover compensation for pain and suffering endured as a result of the accident.

- Property Damage Coverage: It reimburses you for repairs or replacement of your vehicle if it’s damaged in a collision with an uninsured motorist.

- Funeral Expenses: (In some cases) UMC may help cover funeral expenses if you lose a loved one in an accident caused by an uninsured driver.

-

How do I file an Uninsured Motorist Claim?

If you’re involved in an accident with an uninsured driver, follow these steps to file a UMC claim:

- Contact the Police: Report the accident to the police and obtain a copy of the police report. This document serves as crucial evidence for your claim.

- Notify Your Insurance Company: As soon as possible, contact your insurance company and inform them about the accident. Provide details such as the date, time, location, and parties involved.

- Gather Documentation: Collect all relevant documentation, including medical records, repair estimates for vehicle damage, and proof of lost wages (if applicable).

- Cooperate with Your Insurance Company: Respond promptly to requests for information and cooperate throughout the claims process.

- Seek Legal Advice: Consulting with an attorney specializing in personal injury law can be beneficial, especially in complex cases. They can guide you through the legal process and ensure your rights are protected.

-

What are the time limits for filing an Uninsured Motorist Claim?

Time limits for filing UMC claims vary by state. Generally, it’s recommended to file a claim as soon as possible after the accident. This ensures you meet deadlines set by your insurance policy and state law. Missing these deadlines could jeopardize your ability to receive compensation.

-

What are the limitations of Uninsured Motorist Coverage?

While UMC offers significant protection, there are limitations to consider:

- Coverage Limits: UMC has coverage limits, which means there’s a maximum amount your insurance company will pay for damages. Choosing adequate coverage limits is crucial to ensure you’re sufficiently protected in case of an accident.

- Exclusions: UMC may not cover all types of damages. Punitive damages and emotional distress are examples of exclusions that may vary depending on your policy and state laws.

- Hit-and-Run Accidents: In some cases, UMC may not apply to hit-and-run accidents if the uninsured driver cannot be identified.

-

How much does Uninsured Motorist Coverage cost?

The cost of UMC varies depending on several factors:

- Coverage Amount: Higher coverage limits translate to higher premiums.

- Deductible: A higher deductible lowers your premium but requires you to pay more out-of-pocket before your insurance kicks in.

- Driving Record: Drivers with clean records typically pay less for UMC compared to those with accidents or traffic violations on their record.

- Vehicle Type: Sports cars and high-performance vehicles generally cost more to insure than sedans or minivans.

- Location: Premiums tend to be higher in areas with a higher number of uninsured drivers.

Remember: Uninsured motorist coverage is an essential investment that protects you financially in the event of an accident caused by an uninsured driver. Don’t wait until it’s too late. Contact your insurance agent today to discuss UMC options and ensure you have the peace of mind you deserve on the road.