Navigating the complexities of Foreclosure laws for agricultural properties can be a daunting task. This comprehensive guide delves into the intricacies of this legal landscape, providing valuable insights and practical guidance to protect your agricultural assets.

Our in-depth analysis covers the foreclosure process, legal framework, impact on agricultural communities, prevention strategies, case studies, and emerging trends. Whether you’re a farmer facing foreclosure or an investor seeking to understand the risks, this guide will empower you with the knowledge and tools you need to make informed decisions.

Foreclosure Process for Agricultural Properties

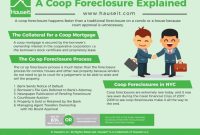

Foreclosure is a legal process that allows a lender to seize and sell a property when the borrower defaults on their loan. The foreclosure process for agricultural properties is similar to that of other types of properties, but there are some key differences. Let’s look at the steps involved and the role of the lender and borrower during this process.

Initiation of Foreclosure

Foreclosure proceedings are initiated when a borrower fails to make mortgage payments as agreed upon in the loan contract. The lender will typically send a notice of default to the borrower, giving them a specific period (usually 30-90 days) to bring the loan current. If the borrower fails to respond or make the necessary payments within the given time frame, the lender may proceed with the foreclosure process.

Legal Proceedings

The lender will file a foreclosure lawsuit against the borrower in the appropriate court. The lawsuit will allege that the borrower has defaulted on their loan and request the court to order the sale of the property to satisfy the outstanding debt.

Sale of Property

If the court rules in favor of the lender, the property will be sold at a public auction. The proceeds from the sale will be used to pay off the outstanding loan balance, any associated costs, and any remaining balance will be returned to the borrower.

Redemption Period

In some states, the borrower may have a right to redeem the property after it has been sold at a foreclosure sale. This is known as the redemption period. The redemption period typically lasts for a period of time (usually 6 months to a year) and allows the borrower to repay the outstanding loan balance and any associated costs to regain ownership of the property.

Foreclosure laws for agricultural properties can be complex and vary from state to state. If you’re facing foreclosure on your agricultural property, it’s important to understand the laws in your state. For more information on foreclosure laws in your state, visit Foreclosure laws in my state . These laws can help you protect your rights and ensure that you’re treated fairly during the foreclosure process.

It’s also important to seek legal advice from an experienced attorney who specializes in agricultural law.

Role of the Lender and Borrower

The lender’s primary goal in a foreclosure is to recover the outstanding loan balance. The borrower’s goal is to avoid foreclosure and keep their property. There are several options available to borrowers facing foreclosure, including loan modification, repayment plans, and bankruptcy.

Foreclosure laws for agricultural properties can be daunting, but help is available. Foreclosure assistance programs can provide financial and legal support to help farmers keep their land. These programs offer a range of services, including mediation, loan modifications, and legal representation.

By exploring these options, farmers can better navigate the foreclosure process and protect their livelihoods.

Legal Framework for Foreclosures

Foreclosure proceedings for agricultural properties are regulated by a complex legal framework that includes both federal and state laws. These laws establish the legal requirements and procedures for initiating and completing a foreclosure, as well as the rights and responsibilities of the borrower and lender throughout the process.

Relevant Federal Laws

- The Bankruptcy Code: Provides bankruptcy protection to farmers and ranchers, including provisions for reorganizing debt and staying foreclosure proceedings.

- The Agricultural Credit Act of 1987: Established the Farm Credit System, which provides loans to farmers and ranchers, and includes provisions for foreclosure.

- The Food Security Act of 1985: Includes provisions for mediation and counseling for farmers facing foreclosure.

Relevant State Laws

In addition to federal laws, each state has its own foreclosure laws that govern agricultural properties. These laws vary from state to state, but generally include provisions for:

- Notice of default: The lender must provide the borrower with written notice of default before initiating foreclosure proceedings.

- Right to cure: The borrower may have the right to cure the default by paying the missed payments and other fees before the foreclosure sale.

- Foreclosure sale: The property is sold at a public auction to the highest bidder.

- Redemption period: After the foreclosure sale, the borrower may have a period of time to redeem the property by paying the full amount of the debt.

Rights and Responsibilities of the Borrower and Lender, Foreclosure laws for agricultural properties

Under the legal framework for foreclosures, both the borrower and lender have certain rights and responsibilities. The borrower has the right to receive notice of default and the right to cure the default. The lender has the right to initiate foreclosure proceedings if the borrower defaults on the loan. Both parties have the responsibility to comply with the legal requirements and procedures for foreclosure.

Foreclosure laws for agricultural properties vary by state, and it’s important to understand the specific laws that apply to your situation. If you’re facing foreclosure on an agricultural property, you may have options available to you under the law. It’s also important to be aware of the laws for condominiums , as they may impact your rights if you own an agricultural property that is part of a condominium association.

Foreclosure laws for agricultural properties are complex, and it’s important to seek legal advice if you’re facing foreclosure.

Options for Preventing Foreclosures

Facing foreclosure can be a stressful and challenging situation for farmers. However, there are strategies and programs available to assist them in preventing foreclosure and safeguarding their agricultural businesses.

Government agencies and non-profit organizations play a vital role in providing support to farmers facing foreclosure. These entities offer various programs and services, including financial assistance, debt restructuring, and counseling. Farmers should explore these options and seek professional guidance to determine the most suitable solutions for their specific circumstances.

Financial Planning and Risk Management

Financial planning and risk management are crucial for agricultural businesses to prevent foreclosure. Farmers should develop sound financial plans that Artikel their income, expenses, and cash flow projections. This enables them to anticipate potential financial challenges and make informed decisions to mitigate risks.

Effective risk management strategies can help farmers minimize the impact of unforeseen events, such as natural disasters, market fluctuations, and economic downturns. By implementing appropriate insurance coverage, diversification of income sources, and contingency plans, farmers can enhance their resilience and reduce the likelihood of financial distress.

Case Studies of Foreclosures: Foreclosure Laws For Agricultural Properties

Real-world examples of agricultural property foreclosures offer valuable insights into the contributing factors and outcomes. These case studies provide lessons that can help landowners avoid similar situations and assist lenders in mitigating risks.

Foreclosure laws for agricultural properties can be complex, and it’s important to understand your rights as a landowner. In some cases, you may be able to avoid foreclosure by working with your lender or seeking legal assistance. If you’re facing foreclosure, it’s also important to know your rights as a homeowner.

For more information on foreclosure rights for homeowners, visit Foreclosure rights for homeowners . Understanding the foreclosure laws for agricultural properties can help you protect your financial interests and ensure a fair outcome.

Case Study 1: Excessive Debt and Unfavorable Market Conditions

A farmer with a large acreage acquired significant debt to expand operations. However, unfavorable market conditions led to lower crop prices and reduced demand, resulting in insufficient income to cover debt payments. The property was foreclosed upon, leaving the farmer facing financial ruin.

Case Study 2: Poor Management and Lack of Planning

A landowner inherited a family farm but lacked the necessary experience and business acumen. Poor crop yields due to improper farming practices and a lack of financial planning led to mounting debts. The property was eventually foreclosed upon, as the landowner failed to implement effective management strategies or seek professional advice.

Case Study 3: Natural Disasters and Unforeseen Events

A severe drought devastated crops, resulting in significant financial losses for a farmer. The farmer was unable to secure insurance or government assistance and defaulted on loan payments. The property was foreclosed upon, leaving the farmer displaced and without a source of income.

Foreclosure laws for agricultural properties can be complex, especially when dealing with vacant land. Foreclosure laws for vacant properties can vary from state to state, so it’s important to understand the specific laws that apply to your situation. However, there are some general principles that apply to all foreclosure laws, including the right to redeem the property, the right to a fair hearing, and the right to legal representation.

If you’re facing foreclosure on your agricultural property, it’s important to seek legal advice as soon as possible.

Lessons Learned

- Manage debt responsibly and avoid overleveraging.

- Stay informed about market conditions and adjust operations accordingly.

- Implement sound farming practices and seek professional guidance when necessary.

- Have a contingency plan in place for unforeseen events such as natural disasters.

- Explore alternative financing options and consider government assistance programs.

Future Trends in Foreclosures

The future of agricultural property foreclosures is likely to be shaped by several emerging issues and trends, including changes in laws, regulations, and economic conditions. These factors could have a significant impact on the frequency and severity of foreclosures, as well as the options available to landowners facing financial distress.

Foreclosure laws for agricultural properties can be complex, but it’s crucial to understand what happens during foreclosure. from the initial notice of default to the final sale of the property. Understanding these laws and processes can help you make informed decisions about your agricultural property and protect your financial interests.

Potential Changes in Laws and Regulations

Several potential changes in laws and regulations could impact agricultural property foreclosures in the future. For example, some states are considering legislation that would make it more difficult for lenders to foreclose on agricultural properties. These laws could include provisions that require lenders to provide more notice to borrowers before initiating foreclosure proceedings, or that allow borrowers to stay in possession of their properties for a longer period of time after a foreclosure judgment has been entered.

Potential Changes in Economic Conditions

Changes in economic conditions could also impact the frequency and severity of agricultural property foreclosures. For example, a downturn in the agricultural economy could lead to a decrease in the value of agricultural land, making it more difficult for landowners to repay their debts. This could lead to an increase in the number of foreclosures, as lenders seek to recoup their losses.

Recommendations for Addressing Future Challenges

In light of these emerging issues and trends, it is important for policymakers and stakeholders to begin considering how to address the challenges that they may pose. Several recommendations can be made in this regard:

- Develop and implement policies that support the agricultural industry. These policies could include measures to stabilize agricultural prices, provide financial assistance to farmers, and promote the development of new markets for agricultural products.

- Strengthen laws and regulations that protect agricultural landowners. These laws could include provisions that make it more difficult for lenders to foreclose on agricultural properties, or that allow borrowers to stay in possession of their properties for a longer period of time after a foreclosure judgment has been entered.

- Provide financial assistance to landowners facing foreclosure. This assistance could include grants, loans, or other forms of financial relief. This could help landowners to avoid foreclosure and stay in business.

- Promote financial literacy among agricultural landowners. This could help landowners to make informed decisions about their finances and avoid getting into debt that they cannot afford.

Ending Remarks

In conclusion, Foreclosure laws for agricultural properties are a complex and evolving area of law with significant implications for farmers, lenders, and communities alike. By staying informed about the legal framework, exploring prevention options, and understanding the potential consequences, you can navigate the challenges and protect your agricultural interests.

FAQ Insights

What are the common reasons for agricultural property foreclosures?

Financial distress, natural disasters, changes in market conditions, and unsustainable debt levels are common triggers for agricultural property foreclosures.

What are the key legal requirements for initiating a foreclosure on an agricultural property?

Lenders must comply with federal and state laws, including providing proper notice to the borrower and adhering to specific timelines and procedures.

What options are available to farmers facing foreclosure?

Government programs, non-profit organizations, and financial institutions offer various assistance options, including loan modifications, payment plans, and counseling services.

How can I stay informed about changes in foreclosure laws for agricultural properties?

Monitor legal updates, consult with agricultural law professionals, and stay connected with industry organizations to stay abreast of the latest developments.