Understanding the nuances of mobile home foreclosure laws is necessary since they differ from those pertaining to traditional real estate. This article explores the special factors, the foreclosure process, and the legal safeguards available to mobile home owners. It offers insightful information that will help you maintain your rights and look into alternatives to foreclosure.

This thorough handbook equips mobile homeowners with the information and tools they need to handle the difficulties of foreclosure and safeguard their properties, from comprehending redemption rights to obtaining legal assistance.

Mobile Home Foreclosure Laws

Because of their distinct legal standing, mobile home foreclosure regulations are different from those pertaining to traditional real estate. Most governments view mobile homes as personal property rather than real property, such as houses or land. Foreclosure procedures are significantly impacted by this discrepancy.

Mobile home foreclosure regulations might be difficult to understand. It’s critical to comprehend your rights and choices if you’re facing mobile home foreclosure. One thing to bear in mind is that the regulations pertaining to foreclosure for unoccupied homes sometimes differ from those pertaining to inhabited properties.

Visit Foreclosure laws for unoccupied properties for additional details on this subject. It’s crucial to have legal counsel when it comes to mobile home foreclosure regulations to make sure your rights are safeguarded.

Mobile home foreclosure rules and types of mobile home foreclosure proceedings

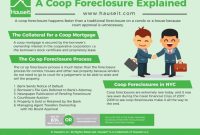

Foreclosure actions against mobile homes can be filed under two main categories:

Judicial Foreclosure: This procedure entails bringing a lawsuit and winning a foreclosure judgment in court. After then, the court will order the mobile home to be sold in order to pay off the remaining debt.

Through a method known as “non-judicial foreclosure,” the lender can foreclose on a mobile home without going thru the legal system. It is usually applied when there is a power of sale clause in the loan agreement, allowing the lender to sell the mobile home in the event of default.

Owners of mobile homes have redemption rights under mobile home foreclosure laws.

The owner of a mobile home facing foreclosure has the right to reclaim the property and stop it from being sold. The redemption time is the name given to this right. The redemption period, which varies by state, starts after the foreclosure sale is finalized and lasts for a set amount of time.

Mobile home foreclosure rules might be complex, although they largely mirror homeowner foreclosure rights. It’s critical to understand your rights if you’re facing mobile home foreclosure. If you take rapid action, you might be able to rescue your house.

- If you’re facing foreclosure, it’s a good idea to talk with an attorney because the regulations pertaining to mobile home foreclosure can be complicated.

- The homeowner must pay the whole amount of the foreclosure judgment, including interest and charges, in order to exercise the right of redemption. By agreeing to a repayment plan with the lender and paying a portion of the judgment, the homeowner can also reclaim the property.

State-by-state variations exist in the complexity of mobile home foreclosure rules. Programs for foreclosure aid are offered to assist those who are facing foreclosure. These organizations can help you prevent foreclosure by offering cash support, legal counsel, and other forms of aid.

It’s crucial to speak with a foreclosure lawyer to find out more about your alternatives and to find out whether you’re eligible for any help. Mobile home foreclosure rules might be complicated, but you can prevent foreclosure and save your house if you have the correct assistance.

Cases of Successful Redemption

Mobile home redemptions have been effective in a number of circumstances. In one instance, a homeowner was able to work out a repayment schedule with the lender and ultimately reclaim his mobile home. In a another instance, a homeowner was successful in getting a loan from a non-profit organization, allowing her to redeem her mobile home.

Mobile home foreclosure rules are intended to shield homeowners from losing their properties as a result of delinquent mortgage payments. If you do, however, fall behind on your payments, it’s critical to comprehend what goes on during the foreclosure process. Clicking this link will teach you more about the foreclosure procedure. State-by-state variations exist in mobile home foreclosure laws, therefore it’s critical to ascertain your rights by consulting your local laws.

Foreclosure’s Effect on Communities of Mobile Homes

Communities suffer greatly from the social and economic fallout from mobile home foreclosures. They may result in blight in the community, loss of cheap housing, and displacement.

Residents in mobile home communities are more likely to be at risk of foreclosure because these communities are frequently found in low-income neighborhoods. The owner of a mobile home facing foreclosure may have to vacate their residence and neighborhood. Families and individuals may experience volatility and upheaval as a result of this.

- A community’s supply of affordable homes may be diminished by foreclosures. For many families, mobile homes are the only reasonably priced housing choice available, therefore it can be challenging for them to locate other inexpensive accommodation when they are foreclosed upon.

- Foreclosures can also result in neighborhood degradation. Abandoned mobile homes have the potential to attract criminal activity and turn into eyesores. Other residents may find it challenging to retain the value of their properties as a result.

- A increasing amount of scholarly literature is describing the effects of foreclosures on communities of mobile homes. According to a National Consumer Law Center research, the number of mobile home foreclosures rose by 50% between 2007 and 2010.

- The survey also discovered that neighborhoods with significant numbers of minority populations and high rates of poverty had a higher likelihood of experiencing foreclosures.

The Center for Responsible Lending discovered in another study that mobile home foreclosures might lower the value of nearby properties. According to the study, properties next to mobile homes that were in foreclosure lost 5% of their value on average.

Communities of mobile homes are negatively impacted by foreclosures, which is a significant issue that requires attention. Many actions, such offering homeowners financial counseling and expanding the availability of affordable housing, may be taken to assist stop foreclosures.

Finalization

The legal environment around mobile home foreclosures is intricate and constantly changing, affecting not just the stability of mobile home communities but also individual homeowners. Mobile homeowners may deal with foreclosure and save their homes by being aware of the legal landscape, getting legal counsel, and looking into other possibilities.

Hub for Questions and Answers

What particular legal issues affect mobile homes differently than those pertaining to conventional real estate?

Conventional real estate is classified as real property, whereas mobile homes are classified as personal property. Legal protections, redemption rights, and foreclosure procedures are all impacted by this discrepancy.

Which kinds of foreclosure actions are available for mobile homes?

Depending on state legislation and the kind of loan, mobile homes may be the subject of strict foreclosure, non-judicial foreclosure, or judicial foreclosure processes.

What rights do homeowners with mobile homes who are in foreclosure have to redeem?

Following a foreclosure sale, mobile home owners are entitled to redeem their properties within a certain time frame. Each state has a different redemption period and procedure.

Which national and state regulations shield homeowners with mobile homes from deceptive foreclosure practices?

Protections against unethical foreclosure practices, such as predatory lending and incorrect foreclosure processes, are offered by the Real Estate Settlement processes Act (RESPA), the Truth in Lending Act (TILA), and state legislation.

What other choices are there for homeowners with mobile homes who are having financial difficulties?

To prevent foreclosure, mobile home owners should look into government aid programs, payment plans, and loan modifications.

Depending on the state in which you reside, there might be significant differences in mobile home foreclosure rules. Visit Foreclosure laws in my state to learn more about the particular laws pertaining to foreclosure in your area. This website offers a thorough rundown of every state’s foreclosure procedure, along with details on homeowners’ and lenders’ legal rights.

Foreclosure on your mobile home may be a stressful and perplexing process. It’s critical to comprehend your state’s foreclosure rules if you’re facing foreclosure. States in my state have different foreclosure laws, so it’s critical to learn about your rights and conduct due diligence.

If you’re facing foreclosure, it’s crucial to have legal counsel since the rules governing mobile home foreclosures can be very complicated.